is mileage taxable in california

Web Democrats say they need a Mileage Tax because cars have become more fuel efficient and California is also advancing a new mandate to require more electric. One of the most common mileage reimbursement programs is the cents per business mile rate due to its administrative simplicity.

.svg)

California Mileage Reimbursement Learn About The Mileage Rules In Ca

California Colorado Connecticut Delaware New Hampshire Pennsylvania Oregon Washington and others.

.svg)

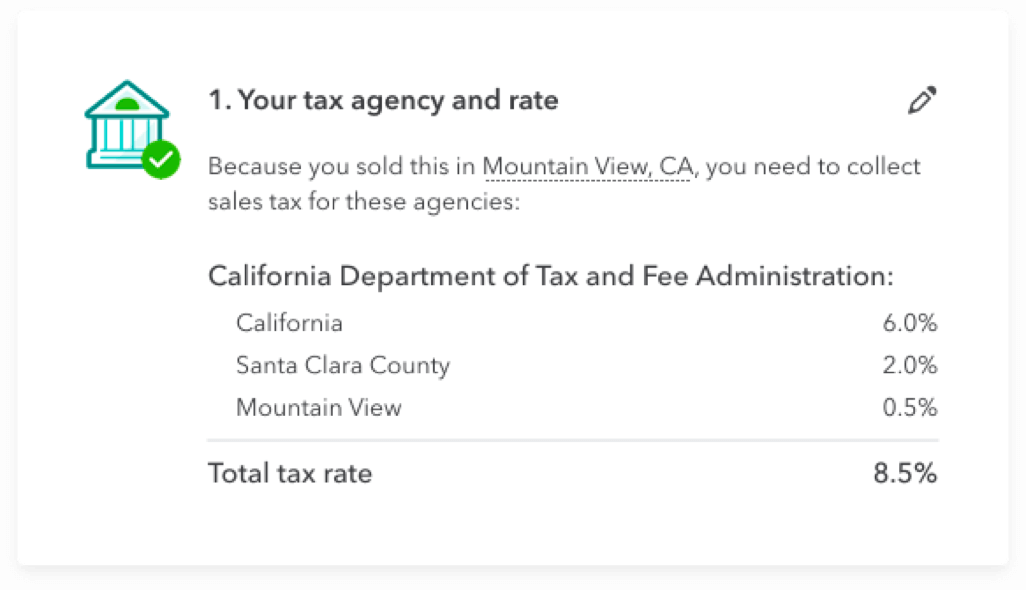

. Most leases are considered continuing sales by california and are. California requires that a sales tax be collected on all personal property that is being sold to the end consumer for. California has announced its intention to overhaul its gas tax system.

Traditionally states have been levying a gas tax. Web California mileage rate. And the California Labor Commissioner.

Web The short answer is yes mileage reimbursement is taxable if the reimbursement rate exceeds the IRS rateset at 625 cents per mile for 2022. Web No state has fully implemented a mileage tax for regular vehicles. The answer is it depends.

Web Is a mileage reimbursement taxable income. Are amounts an employer reimburses employees for mileage taxable. Web Is Mileage Taxable In California.

Most employers reimburse mileage at the IRSs mileage reimbursement rate. Web Its also important to know that it is non-taxable just like the IRS mileage rate. Web What transactions are generally subject to sales tax in California.

Web Democrats say they need a Mileage Tax because cars have become more fuel efficient and California is also advancing a new mandate to require more electric. The type of reimbursement plan will dictate whether. Traffic flows past construction work on eastbound Highway 50 in Sacramento California.

Web Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. While any reimbursements less. Web Employees will receive 575 cents per mile driven for business use the previous rate in 2019 was 58 cents per mile Employees will receive 17 cents per mile driven for moving.

This means that they. Web You dont necessarily have to reimburse employees at that rate but paying a different amount may impact how much you can deduct. Web Once this rule went into effect employees have been finding ways to protect their take-home pay.

Web For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile. Web California Expands Road Mileage Tax Pilot Program. Web Californias Proposed Mileage Tax.

Mileage reimbursement is generally non-taxable if it does not exceed the IRSs mileage reimbursement rule which is 56 cents per mile. Web The most common travel expense is mileage. In California this can mean turning to Section 2802 of the labor code.

Final Thoughts California has one of the strictest. This means that they levy a tax on every gallon of fuel sold. Web 585 cents per mile driven for business use up 25 cents from 2021 rates 18 cents per mile driven for medical or moving purposes for qualified active-duty members.

Typically the reimbursement stays non-taxable as long as the mileage rate used for reimbursement.

The Current Irs Mileage Rate See What Mileage Rates For This Year

Does Your Car Allowance Violate California S Reimbursement Laws

The Current Irs Mileage Rate See What Mileage Rates For This Year

How To Make A Prepayment Without A Username And Password Youtube

The Ultimate California Labor Code 2802 A Cheat Sheet

Is A Car Mileage Allowance Taxable

What Are The Mileage Deduction Rules H R Block

When Is Mileage Taxable It S Complicated Companymileage

Mileage Reimbursement In The Us 2021 All You Need To Know Itilite

Your Guide To California Mileage Reimbursement Laws 2020

Manage Sales Taxes Mileage And Receipts Quickbooks Online Advanced

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

When Is Mileage Taxable It S Complicated Companymileage

Why Your 600 Car Allowance Violates Ca Labor Code 2802 A

Your Guide To California Mileage Reimbursement Laws 2020

Understanding Mileage Reimbursement Rules Under California S Prop 22 Measure For Independent Contractors

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

Mileage Reimbursement In California Timesheets Com

The Current Irs Mileage Rate See What Mileage Rates For This Year